Add Your Heading Text Here

The State of Cannabis Cultivation Legislation in the United States

The cannabis market in the United States is growing steadily and is projected to bypass US$51.28bn by the end of 2023. At the same time, the legislation is getting more and more intricate.

This article will give you a quick overview of the history and current state of commercial marijuana growth regulation. Of course, it is impossible to cover every state’s specific aspects. For detailed information, seek a professional lawyer’s advice.

U.S. Cannabis Legislation: A Historical Overview

Until the early 20th century, cannabis was widely used and grown in the U.S. Then, the public perception of marijuana changed, and a wave of regulations and prohibitions swept across the country. The Marihuana Tax Act of 1937 became the pinnacle, effectively outlawing cannabis nationwide.

It all changed in 1996. The passage of Proposition 215 in California made it the first state to legalize medical marijuana. Since then, the pace of cannabis decriminalization only grew, with more and more states legalizing medical use.

2012 became another breakthrough year when recreational use became legal in Colorado and Washington State.

Political Landscape

According to MjBizDaily, today, the recreational use of marijuana is legal in 22 states and the District of Columbia, while 40 states and DC have legalized it for medical use.

Still, at the federal level, cannabis remains classified as a Schedule I drug under the Controlled Substances Act. This discrepancy between state and federal law remains the root of many challenges for growers, businesses, and consumers.

Today, cannabis cultivation licenses are available in no less than 20 states and territories. Requirements and legislative barriers vary drastically depending on the state. However, some standard rules are relevant for most states.

For instance, regulations often include seed-to-sale tracking systems, testing requirements for potency and contaminants, and stringent packaging and labeling standards.

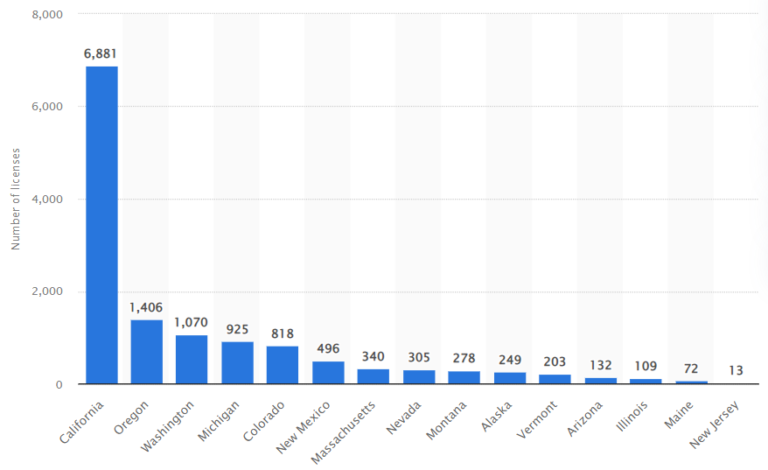

Here is Statista’s data on the number of cultivation licenses issued by the end of 2022 by state:

As you can see, California is the leader by a huge margin. Apart from an excellent climate, there are a few reasons for that:

• Early adoption of marijuana for medical and recreational use has given the state a head start in establishing a mature cannabis industry.

• As the most populous state in the U.S. and a popular tourist destination, California has a large consumer base for cannabis.

• A relatively progressive attitude towards marijuana has contributed to developing the state’s cannabis industry.

• A comprehensive regulatory framework for cannabis cultivation, sales, and use provides some certainty for businesses operating in the state.

In Thompson Coburn’s “Cannabis State-by-State Regulation” report, California firmly holds first place as the most cannabis-friendly state. However, even there, the regulatory framework is very complex.

For instance, to open a cannabis business, an entrepreneur must meet a number of requirements, including:

• Be a resident of California

• Pass a background check

• Provide proof of a legal right to use the proposed location

• Apply for and obtain a valid seller’s permit

• Provide proof of bond

• Describe the operating procedures in detail

With various state-specific rules, navigating this landscape without an experienced lawyer is virtually impossible. However, there are several common challenges that growers face countrywide.

Main Challenges Cannabis Growers Face

The cannabis industry is an excellent example of a high-risk, high-reward sector. The legislative landscape changes on the fly, and that is not the only challenge growers face. Here are some of the others:

Legal Uncertainty: Despite state-level legalization, the threat of federal enforcement action still looms large. This uncertainty creates a risky environment for investment and long-term business planning.

Banking and Financing: Federal laws make accessing financial services difficult for cannabis-related businesses (CRBs). Many banks and credit unions are reluctant to service CRBs due to the risk of federal prosecution. This lack of access to traditional banking and financial systems forces many cannabis businesses to operate on a cash-only basis, creating operational difficulties and heightening security risks.

Taxation: Under IRS Code 280E, unlike other businesses, CRBs are not allowed to deduct ordinary business expenses from their income. This results in extremely high effective tax rates, which significantly affect profitability.

Interstate Commerce: Due to federal prohibition, interstate commerce of cannabis is illegal. This forces growers to operate within the constraints of individual state markets, limiting their potential for expansion and profit.

Research and Development: Federal prohibition also limits the ability to conduct extensive research on cannabis. This stifles innovation and hampers the development of best practices for cultivation and processing.

As public opinion continues to shift towards accepting cannabis, there is a strong impetus for change at the federal level. Potential solutions include federal legalization efforts, banking reform, harmonization of regulations, and market diversification.

Implementing them will contribute to a more sustainable, equitable, and prosperous cannabis industry in the United States.