Add Your Heading Text Here

Cannabis Retail Legislation in the US: Current State and Challenges

Cannabis Grey Zone: Federal vs. State Legislation

As we’ve already mentioned in our cannabis cultivation legislation overview, at the federal level, marijuana remains a Schedule I drug under the Controlled Substances Act, alongside substances like heroin and LSD. However, the federal stance is increasingly discordant with individual state laws and public opinion.

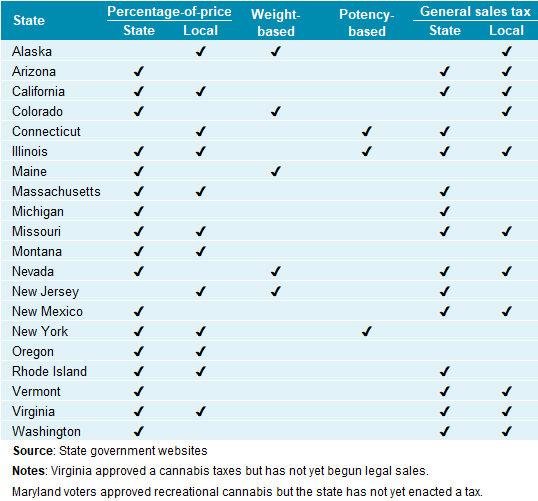

Since moving cannabis between states is prohibited by federal law, besides creating its own legislation for cultivation and retail, each state imposes its own taxation policy. Both may vary drastically across the country.

For instance, here are the types of additional sales taxes imposed in 15 states:

Find state-specific data on tax rates here.

The discrepancy in state legislation presents both opportunities and challenges for the retail cannabis industry. While businesses can capitalize on the evolving market, adapting to different states’ regulatory frameworks to maximize profits, the patchwork nature of the laws makes operating on a national scale difficult.

While states may permit cannabis sales, federal law still criminalizes the possession, use, and sale of cannabis, creating a gray area in which businesses operate.

Financial Uncertainty for the Cannabis Industry

Legal implications make cannabis retail companies face difficulties securing basic business necessities like banking services and insurance coverage.

Banks, being federally regulated, are often reluctant to provide services to cannabis-related businesses due to potential legal ramifications, such as being implicated in money laundering. This forces many cannabis businesses to operate primarily in cash, making them targets for theft and increasing operational difficulties.

As a result, the industry’s transparency is hindered, complicating the accurate tracking of finances and taxes.

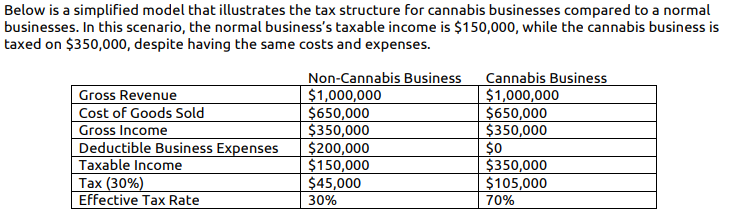

The uncertainty extends to taxation as well. Due to IRS Code Section 280E, cannabis businesses cannot deduct most business expenses from their taxable income, which means that effective tax rates for the industry can reach astronomical levels.

This code section was initially enacted to prevent drug traffickers from claiming their illegal activities as legitimate business expenses. However, in today’s changing landscape, it has become a burden for legal cannabis businesses.

Another challenge is related to insurance. Carriers are hesitant to underwrite policies for cannabis businesses due to the legal ambiguity and perceived risks. This leaves companies vulnerable to a variety of potential losses without adequate protection.

Grounds for Optimism

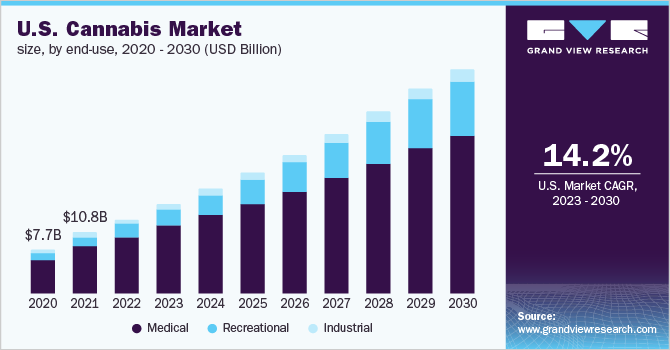

So far, we’ve been discussing the plethora of difficulties faced by cannabis retailers. But if you thought these challenges were fatal for the industry, look at the numbers. Cannabis market growth is speeding up. According to Grand View Research’s report, it is expected to expand at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030.

Despite all the challenges, the cannabis industry has shown remarkable resilience and adaptability. And to support further growth, stakeholders are lobbying for reform, such as the SAFE Banking Act, which would allow banks to serve cannabis businesses without fear of federal penalties.

There are also calls to reform IRS Code Section 280E to provide a fairer taxation environment for cannabis businesses.

Steps in The Right Direction for the Cannabis Industry

Some steps have already been made, such as introducing the Marijuana Opportunity Reinvestment and Expungement (MORE) Act in Congress. However, real progress on this issue is yet to be made.

But legislation is only one piece of the puzzle. For the cannabis retail industry to thrive, the stigma associated with cannabis must also be addressed. This may involve public education campaigns, professional training, and partnerships between cannabis businesses and mainstream service providers.

Nevertheless, the industry’s future will largely be determined by the ability of policymakers to enact fair and supportive legislation. It is an area of law and commerce that is both challenging and exciting, promising economic growth and social progress opportunities.